Small Businesses have been affected badly by the impact of COIVD19 pandemic on the world. With the increase, in the number of positive cases, the business has already started to feel the financial crunch. Many of them are failing to pay their rent, employee salary, and other debt bills. Like on March 18, President Trump stated that the restaurant industry will lose more than $225 billion if the pandemic lasts more than 3 months. There are other industries affected too.

But to cover those losses world leaders & philanthropists like Gates Foundation are joining hands to help the small and medium-sized enterprises to fight against the crisis caused by COVID19 pandemic. Many states in the US have already started providing small business coronavirus aid programs in the form of funds & low-interest loans to back them during the crisis.

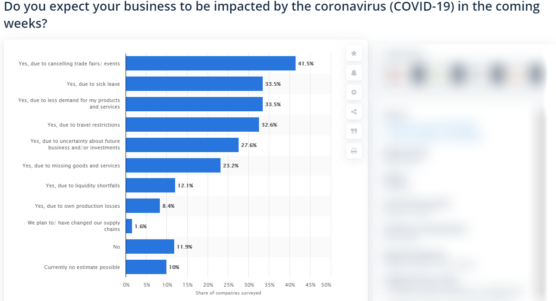

The above stats show what business owners think about the impact of COVID19 on their business. Every country is taking all the necessary steps to fight COVID19 impact on our global economy. The federal government has already started to offer various emergency relief programs, grants, emergency funding and more to help small businesses in paying their basic bills.

In the recent G20 summit, leaders of G-20 decided to inject $5 trillion into the global economy to fight the COVID19 pandemic. All the countries of the G-20 agreed to fight the coronavirus by sharing potential health data addressing potential trade disruption. At a press conference, Donald Trump stated that they will share all the potential information and data with G-20 leaders to fight coronavirus pandemic.

So in this article, we will be giving you all the details related to loans, emergency reliefs, grants and funds offered by different cities in the US to help small businesses in paying their basic and dept bills.

Assistance offered by the Federal Government to Fight Coronavirus (COVID19) impact on small businesses

Today almost every small business around the world is standing on the edge due to the economic crisis caused by the COVID19 pandemic. If your business is among them and seeking any help to cover the Losses then go through the small business coronavirus aid program provide by different States and cities in the US.

1. Income tax filing and payment deadline extension

With the increase in the number of COVID19 positive cases, many businesses have already begun to feel the financial crunch. That’s why the federal tax filing deadline is pushed to 15 July 2020.

The Treasury Department and the internal revenue service are offering tax filing and payment relief to businesses facing financial issues. There will be no penalties and interest on taxes paid before July 15, 2020. (if the effect of the coronavirus grows that they may extend the days depending on the situation).

Most of the state tax agencies in the U.S. have already begun to extend the dates and deadlines of the local tax payment. You can check with your state tax agency to know about the deadline of your tax payment

2. Small Business Assistance (SBA) Economy Disaster Loan Assistance

Due to the recent crisis, The U.S. Small business Assistance(SBA) is offering low-interest economic disaster loans up to $2 million (3.75% for small business and 2.75% for nonprofit organization) to working capital and small business suffering from COVID19 pandemic. The repayment policy of the loan can go up to 30 years.

Now the question is who can apply for the loan. From the updated report, businesses in every state plus American Samoa, Guam, the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands can apply. The loan can be used to pay the debt amount, employee bill, rent, and other bills.

You can click here to apply for Small Business Assistance (SBA) Economy Disaster Loan Assistance. You have to provide a few documents like your tax return, personal financial statement, etc to avail advantages of loan. For more details, you can contact SBA assistance customers service center at 1-800-659-2955

3. SBA ”Paycheck Protection” loan program

Recently on March 25, 2020, senet announced a Coronavirus relief program of $2.2 trillion to support states, businesses affected badly by the impact of COVID19 pandemic. Recently US small business administration (SBA) offered low-interest loan up to $10 million with the interest rate of 4%v

Keeping the effect of pandemics into consideration SBA is allowing businesses with employees less than 500 to take the loan for a term of up to 10 years. To know more about the paycheck protection loan program click here

4. Small Business Resiliency Fund (San Francisco)

There are many small businesses and companies in San Francisco affected badly by the impact of COVID19. To pay for the basic wages like rent, employee salary, and other debt bill businesses with employees between 1 to 5 can apply for the Small Business Resiliency Fund. Any business operating in San Francisco can apply for funding of up to $10,000.

There are a few conditions of funding like you have to show a 25% drop in your revenue, your business gross receipt should be less than $2.5 million. And your business should have a San Francisco operational license.

If your business is located in San Francisco and looking for funding due to the Covid19 pandemic then click here to fill the online application. You have to attach the application form with all the documents and send them to investsf@sfgov.org.

5. Small Business Emergency Microloan Program

To provide aid to small and medium-sized enterprises, the city of Los Angeles is offering a microloan program. Small businesses having less salaried employees can take advantage of the microloan to get up to $5000 to $20,000. Taking the microloan will help you to cover your employee expenses when they stay quarantined.

Microloan program offers two different options for interest rate:

- If you are taking the loan for 18 months then your interest rate will be 0%.

- Expanding the loan term for 5year will increase the interest rate up to 3%

To get the benefits of microloan you have to provide a reasonable and clean credit history, your business should be located with the city of Los Angeles. And you have to provide a three-month bank and financial statement to ensure that you are taking the loan only for business purposes.

You can click here to know more details about the coronavirus assistance loan. You can fill the application form and provide all necessary document lines: your tax return, bank statement, the reason for taking the loan, and details about your credit history.

6. Small Business Emergency Relief

Recently Denver Economic Development & Opportunity (DEDO) with Denver Mayor Michael B. Hancock, announced aid for the small and medium-sized enterprises affected by the coronavirus pandemic. Businesses facing difficulties in paying their rent, employee salary and other debt bills can apply for emergency relief up to $7500.

Click here to apply for the small business emergency relief. all types of businesses including restaurants, retail shops, salons and more are eligible to the advantage of the relief. The amount will be distributed monthly depending on the pandemic situation. To know more details

7. Small business Emergency Bridge Loan program (Florida)

With the increase in the COVID19 pandemic, many small businesses in Florida are facing problems in managing and running their business without any profit. To alleviate those difficulties Florida government offered a loan program to small and medium-sized enterprises (SMEs) to keep business afloat during the crisis. All the businesses of 67 counties in Florida can apply for the loan to pay their basic wages and debt bill.

Now you might be wondering what type of businesses are eligible for the loan program? Any private business with employees between 0-50 can apply for the small business emergency bridge loan program. Remember only one loan per eligible business.

To take the benefits of the loan you need to fill the application and submit it before May 8, 2020. And don’t forget to attach all the necessary documents like a bank statement, tax return, business statement.

8. Small Business Resiliency Fund(Chicago)

To help small businesses fight global crises caused by the outbreak of coronavirus the city of Chicago is providing low-interest loans up to $50,000. The exact amount of your loan depends on your gross receipt during the pandemic and before the outbreak of COVID19.

There are a few criteria that you have to fulfill like your business should have less than 50 employees and revenue less than $3million in 2019. And a document stating your business suffered a drop of 25% due to the COIVD19 pandemic.

If your business falls under the city of Chicago, then you apply for the Small Business Resiliency Fund. it allows businesses to repay the loan amount for up to 5 years. You can fill the application and provide all necessary documents including Chicago business permit, tax return and more.

9. Small Business Relief Program (Michigan)

Recently the state of Michigan has provided aid to the small business hit by Coronavirus pandemic. They are proving funds and low-interest loans to support small businesses during the crisis. Small businesses can use funding up to $1000 to pay the rent, employee salary and more. If your business is looking for more support then you can take the low-interest loan for up to $50,000 to $200,000. By considering the future damage Michigan Economic Development Corporations are offering low-interest rates up to 0.25%.

If your business has employees between 0 – 50 then you can apply for funds offered by MEDC. you have to provide the document proving your revenue has dropped due to the COVID19 pandemic.

If your business has employees less than 100 and finding it difficult to pay their salary then you can apply for the coronavirus assistance loan offered by the Michigan Economic Development Corporations Department. By providing all the supportive documents like revenue drop and clear credit history and more you can take the loan to support your business’s financial status. For more updates about the grant and loan, you can visit their website.

10. NYC Employee Retention Grant Program (New York City)

Today almost every one of us knows that people around the globe are facing difficulty in keeping their job. Due to the financial crisis, many companies have started to sack employees and most of the businesses are struggling to pay the basic salary of the employee.

So to where small businesses having 2 – 4 employees can apply for the grant up to $27000. The NYC Employee Retention Grant Program allows businesses to pay 40% of their employee paycheck amount for two months.

To apply for the grant program you need to provide evidence that shows your business revenue dropped to 25% in the last three months. Your business should be located in the new york city and you need to provide documents like your 2019 gross receipt, employee salary receipt, and more.

You can visit the New York city department of Small Business Service website to apply for the grant program. To get more information on the grant program terms & conditions and documentation requirements check their website.

11. Small Business Continuity Fund (New York City)

To support small business and medium-sized enterprises, New York City is offering a Small Business Continuity Fund. Any business facing difficulties in continuing their business for long due to COVID19 can apply for the fund. Have a focus to keep the small business afloat during the economical crisis.

What type of business is eligible for the fund? Any business having employees between 10 – 100 can get interest free loans up to $75000 to cover basic expenses. Also, you have to provide documentation that shows your business suffered a 25% drop during the pandemic. And your bank states to confirm that you can repay the amount later. Providing these documents will help you to know the loan amount you can take for your business.

You can click here to fill the interest form provided by the New York City Department of Small Business Service to get notified when they start taking applications. You have to provide a bank statement, 2019 gross receipt tax return to take advantage of the loan to cover the losses and pay the basic wages.

12. Emergency Business Assistance program (Beverton, Oregon)

Today with the increase in the number of COVID19 positive cases, many countries have declared an emergency which is forcing small businesses to close their duress. That’s why Beverton, a city in Oregon, is offering coronavirus assistance programs to all the small and medium-sized businesses affected by the impact of COVID19 pandemic. Businesses losing revenue can get $2500 per month to pay their rent or mortgage.

So, to get the coronavirus assistance fund you have to apply by submitting an inline application with few documents. Total funding amount for coronavirus assistance program is offered is based on a first come first serve basis. Attach the application with all the documents like your rental lease/agreement or mortgage papers and paper stating your business located in Beaverton.

13. Hillsboro Small Business Emergency Relief Program

The City of Hillsboro in Oregon has announced a relief program for small businesses affected by the COVID19 pandemic. All the businesses like restaurants, salons, bars and more looking for grants in Hillsboro can apply for the small business emergency relief to get up to $5000 to cover their basic losses.

If your business has employees between 1 – 10 then you can apply for the small business relief program. You can visit their website to fill the online application and price all the necessary documents like your tax id number and your business license number.

Conclusion

Today almost every small and medium-sized business is struggling to pay their rent, employee salary, and other debt bills due to the reduction of footfalls in the market caused by the COVID19 pandemic. Many small businesses and medium-sized enterprises are facing difficulties in keeping their business afloat during the crisis that is why they are trying to defer the bill and loan amount.

To cover those losses the federal government is taking all the necessary steps by providing all the essential financial aid like emergency relief, low-interest loans, and grants. If your business is failing to survive during a pandemic then you can apply for the loan and grants depending on your city to pay your basic bills and keep your business afloat until the pandemic ends.

Frequently asked questions

1. What is the type of coronavirus?

Many of you may not know that the coronavirus virus belongs to the large species of the virus that are commonly found in the human body like cough, fever, etc. Other than humans it is also found in the different species of animals, like bats, cats. Camel etc. If any hums stay in contact with a coronavirus infected animal then the person can get infected and it can start spreading between humans.

2. What is the treatment for the coronavirus disease?

It’s sad to hear that there is no specific treatment for coronavirus disease. For now, doctors are trying to mitigate the symptoms’ effect by taking necessary precaution measures. If your body is showing any symptoms of coronavirus then contact the nearest doctor. Ask them what you should do next to know whether you are COVID19 positive or not and it’s recommended to go according to the doctor’s suggestion.

3. Is a headache a symptom of the coronavirus disease?

A coronavirus positive can have several symptoms like dry cough, body ache, fever, breathing problem and more. So, if your body is showing all the above symptoms then there are chances you might be infected from COVID19. But headache, in particular, is not the symptom of coronavirus disease.

4. Are masks effective against coronavirus disease?

Yes, wearing mass is an effective prevention measure to avoid getting infected with the COVID19 virus. If you are sneezing and coughing then it is suggested to wear a mask as it will save others from getting it. If you are using masks then remember to sanitize it regularly and always wash your hands after removing your mask. This type of practice will help in mitigating community spread of COVID19.

5. Can babies get coronavirus disease?

A recent report of COVID19 cases shows that all types of age groups can get infected from coronavirus disease. But around the globe hospitals are seeing only a few cases of children which indicates that children can get affected but depends on their immunity system to fight the COVID19 virus.

6. Is the coronavirus disease a pandemic?

With the increase in the number of coronavirus positive cases WHO (World Health Organization) proclaimed COVID19 as a global pandemic. There have been pandemics in the past caused by the influenza virus. but with the recent outbreak of the COVID19 pandemic, many human lives and businesses are at risk.

7. Is it good to travel during C the coronavirus disease outbreak?

After seeing a surge in the number of Coronavirus active cases in different countries, we would recommend you not travel to any destination. Traveling during the outbreak can put your life at high-risk as coronavirus spreads from person to person. COVID19 pandemic has forced countries to shut down all of their international flight functioning. And most of the countries have already closed their doors for the domestic flights.

8. Can coronavirus disease spread through drinking water?

There is no evidence of coronavirus spreading through water. However, we recommend you not share water with any second-person, not even with your family members until the impact of the outbreak reduces. Always drink filtered water.

9. What is meant by the “presumptive positive case” for the coronavirus disease?

A person is counted as a “presumptive positive case” when they get tested positive by the public health laboratory but your confirmation of being COVID19 positive is pending from CDC. A person is categorized coronavirus positive only after the confirmation report from the centers of disease control (CDC).

10. What are the symptoms of Coronavirus Disease?

If your body starts showing symptoms like dry cough, body aches, fever, and breathing problems then there are chances of you being COVID19 positive. there are times when you may get cough and cold so don’t get panic. Reach out to any doctor get it tested form CDC to know whether you are COVID19 positive or not.

(Source – Forbes)